SCENARIO 14-15

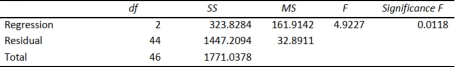

The superintendent of a school district wanted to predict the percentage of students passing a sixth-

grade proficiency test. She obtained the data on percentage of students passing the proficiency test

(% Passing), mean teacher salary in thousands of dollars (Salaries), and instructional spending per

pupil in thousands of dollars (Spending) of 47 schools in the state. Following is the multiple regression output with Passing as the dependent variable,

Salaries and Spending:

ANOVA

-Referring to Scenario 14-15, the null hypothesis should be rejected at a 5% level

of significance when testing whether instructional spending per pupil has any effect on

percentage of students passing the proficiency test, taking into account the effect of mean teacher

salary.

Definitions:

Soft Loans

Loans that are offered with more favorable terms than market loans, typically including lower interest rates and longer repayment periods.

Developing Countries

Nations with a lower level of industrialization, lower standard of living, and lower Human Development Index compared to developed countries.

International Development Association

A part of the World Bank that helps the world’s poorest countries by providing loans and grants for projects and programs that boost economic growth and improve living conditions.

Private Capital Investment

The spending of resources by private individuals or enterprises on assets expected to yield returns over time, such as shares, real estate, or machinery.

Q37: Referring to Scenario 16-15-A, if a five-year

Q43: Referring to Scenario 16-14, the best interpretation

Q49: Referring to Scenario 14-6, _% of the

Q89: The parameter estimates are biased when collinearity

Q102: Referring to Scenario 13-14-A, if you purchase

Q106: Referring to Scenario 13-3, the least squares

Q115: Referring to Scenario 13-10, what is the

Q219: Referring to Scenario 14-3, to test for

Q268: Referring to Scenario 14-14, the predicted mileage

Q289: Referring to Scenario 14-4, what are the