SCENARIO 14-17

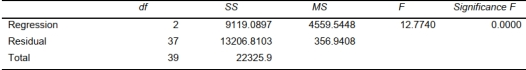

Given below are results from the regression analysis where the dependent variable is the number of

weeks a worker is unemployed due to a layoff (Unemploy) and the independent variables are the age

of the worker (Age) and a dummy variable for management position (Manager: 1 = yes, 0 = no) .

The results of the regression analysis are given below:

-Referring to Scenario 14-17, which of the following is a correct statement?

Definitions:

Compromise Dividend Policy

An approach to dividend disbursement that attempts to balance the interests of shareholders preferring regular dividends with those favoring reinvestment of profits.

Positive Net Present Value

Indicates that the present value of future cash flows from an investment exceeds the initial investment cost, suggesting profitability.

Debt-Equity Ratio

A measure of a company's financial leverage, calculated by dividing its total liabilities by its shareholder equity.

Stock Repurchase

A company's buying back of its own shares from the marketplace, reducing the number of outstanding shares and often increasing shareholder value.

Q41: Referring to Scenario 14-15, what is the

Q44: In multiple regression, the _ procedure permits

Q54: Referring to Scenario 12-4, which test

Q92: Referring to Scenario 15-3, suppose the chemist

Q111: Referring to Scenario 15-6, the model

Q125: If the residuals in a regression analysis

Q156: Referring to Scenario 12-7, there is sufficient

Q195: Referring to Scenario 16-15-B, what is the

Q295: Referring to Scenario 14-16, what is the

Q388: Referring to Scenario 14-20-B, which of