SCENARIO 5-11 There Are Two Houses with Almost Identical Characteristics Available for Available

SCENARIO 5-11

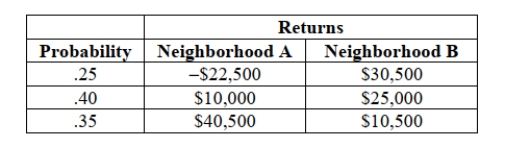

There are two houses with almost identical characteristics available for investment in two different

neighborhoods with drastically different demographic composition. The anticipated gain in value

when the houses are sold in 10 years has the following probability distribution:

-Referring to Scenario 5-11, if your investment preference is to minimize the amount of risk that

you have to take and do not care at all about the expected return, will you choose a portfolio that

will consist of 10%, 30%, 50%, 70%, or 90% of your money on the house in neighborhood A and

the remaining on the house in neighborhood B?

Definitions:

Anxious

Feeling of worry, nervousness, or unease about something with an uncertain outcome.

Narcissist

An individual exhibiting excessive self-love or self-centeredness, often associated with a lack of empathy and a need for admiration.

Grandiose View

An inflated self-concept, often characterized by overestimations of one’s importance, abilities, or achievements.

Self-Serving Bias

The common tendency to attribute positive outcomes to one's own character but attribute negative outcomes to external factors.

Q32: The Laspeyres price index is a form

Q35: Describe probabilities of the k outcomes of

Q61: Referring to the histogram from Scenario 2-10,

Q87: The Paasche price index reflects more accurately

Q104: Referring to Scenario 11-11, what is

Q168: Referring to Scenario 1-1, the possible responses

Q177: Referring to Scenario 1-2, the possible responses

Q193: Referring to Scenario 5-11, if you can

Q218: The sum of cumulative frequencies in a

Q309: The director of a training program