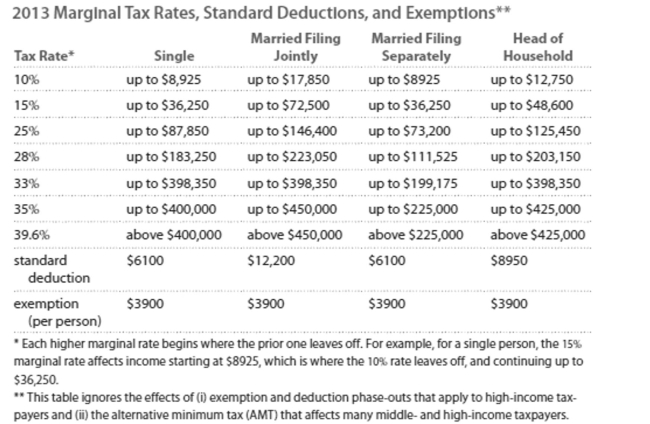

Solve the problem. Refer to the table if necessary.

-Matt is single and earned wages of $32,338. He received $421 in interest from a savings account. He contributed $588 to a tax-deferred retirement plan. He had $579 in itemized deductions from

Charitable contributions. Calculate his taxable income.

Definitions:

Significance Level

The probability of rejecting the null hypothesis in a statistical test when it is actually true, commonly denoted as alpha (α).

Population Locations

Refers to the theoretical or actual positions of individuals or entities within a specified area or space; in statistics, it may involve the central tendencies of a population data set.

Independent Samples

Refers to groups in a study that are not related or paired, ensuring that measurements from one sample do not influence the measurements from another sample.

Wilcoxon Rank Sum Test

A nonparametric test used to determine whether two independent samples come from the same distribution.

Q1: With tax-exempt investments, you never have to

Q29: You are married filing jointly and have

Q56: <span class="ql-formula" data-value="\mathrm { t } -

Q87: <span class="ql-formula" data-value="\frac { 3 } {

Q92: The population density in country A

Q107: <span class="ql-formula" data-value="\left( 25 \times 10 ^

Q143: Shortly before a mayoral election, a

Q147: I figured out the distance we had

Q165: By 2040 projected Social Security payments will

Q175: Ashton maintains an average balance of $1300