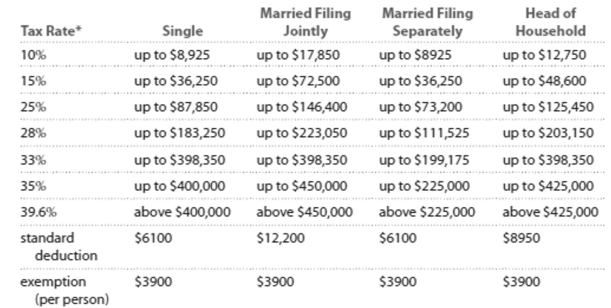

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductions, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle- and high-income taxpayers.

-You are married filing jointly and have a taxable income of $287,874. You make monthly contributions of $1095 to a tax-deferred savings plan. Calculate the effect on annual take-home pay

Of the tax-deferred contribution.

Definitions:

Coercive Appeal

A marketing or persuasive strategy that uses pressure, threats, or intimidation to encourage action or compliance.

Competitors' Offerings

The range of products or services provided by rival companies in the market, which may influence a business's strategic decisions and positioning.

Ripped Abdominal

Muscular definition in the abdominal area, indicating low body fat and well-developed core muscles.

Sex Appeal

The use of sexually suggestive images or features to attract attention to a product or brand.

Q73: A researcher interviews 19 work colleagues who

Q135: <span class="ql-formula" data-value="\frac { 6 } {

Q157: All of your income for the year

Q158: You invest $800 in an account that

Q192: How much profit per share did

Q203: Suppose that you want to construct

Q223: You are interested in the percentage of

Q225: For the study described below, identify the

Q263: A city has a deficit of $31.4

Q277: 6.00000963 minutes<br>A)4 significant digits, precise to the