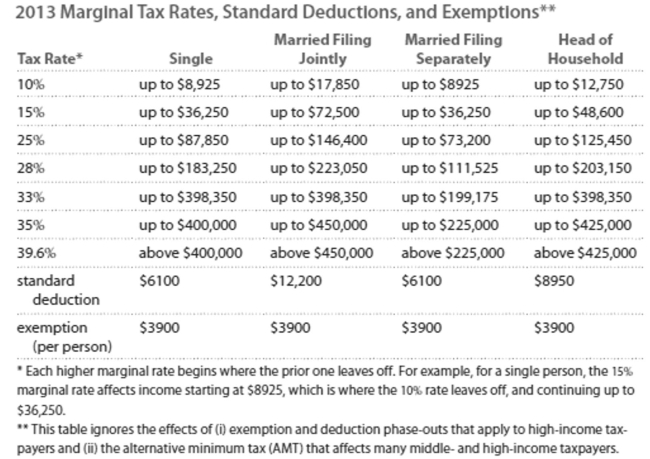

Solve the problem. Refer to the table if necessary.

-Kelsey earned $65,208 in wages. Conner earned $65,208, all in dividends and long-term capital gains. Calculate the overall tax rate for each, including both FICA and income taxes. Assume they

Are both single and take the standard deduction. Note that long-term capital gains and dividends

Are taxed at 0% for income in the 10% and 15% tax brackets and at 15% for income in all higher tax

Brackets.

Definitions:

Nature-nurture Debate

A longstanding discussion concerning the relative importance of an individual's inherited traits (nature) versus environmental influences (nurture) in determining behavior and development.

Gene-environment Interaction

The complex interplay between genetic predisposition and environmental factors that influence the development and expression of traits and behaviors.

Evolutionary Psychology

A conceptual framework in psychology that seeks to understand beneficial mental and psychological characteristics—like memory, perception, or language—as adaptations, meaning they are functional outcomes of the process of natural selection.

Universal Need

Fundamental requirements that are common to all humans, essential for mental and physical well-being, such as the need for safety, love, and esteem.

Q8: The manager of an electrical supply

Q18: You burn 300 Calories will exercising for

Q19: <span class="ql-formula" data-value="\frac { 2 } {

Q23: <span class="ql-formula" data-value="0.52"><span class="katex"><span class="katex-mathml"><math xmlns="http://www.w3.org/1998/Math/MathML"><semantics><mrow><mn>0.52</mn></mrow><annotation encoding="application/x-tex">0.52</annotation></semantics></math></span><span

Q29: An object has a total volume

Q33: You are considering buying 15 silver coins

Q62: A(n)_ deduction is the addition of all

Q107: <span class="ql-formula" data-value="\left( 25 \times 10 ^

Q144: <span class="ql-formula" data-value="69.6"><span class="katex"><span class="katex-mathml"><math xmlns="http://www.w3.org/1998/Math/MathML"><semantics><mrow><mn>69.6</mn></mrow><annotation encoding="application/x-tex">69.6</annotation></semantics></math></span><span

Q176: 400 million, 8 trillion<br>A) <span