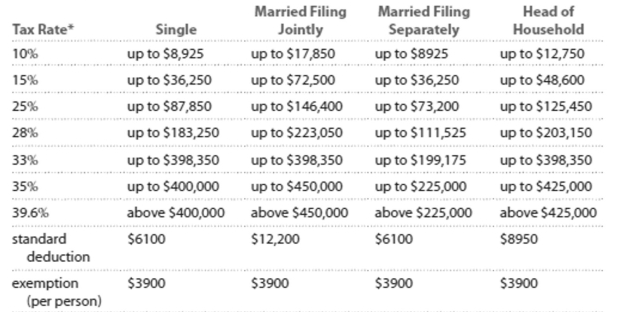

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductlons, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle- and high-income taxpayers.

-Stephen earned $62,292 from wages as an accountant and made $2987 in interest. Find how much he paid in FICA and income taxes. Assume he is single and takes the standard deduction.

Definitions:

Economic Growth

An increase in the production of goods and services in an economy over a period of time, typically measured by the change in Real GDP.

Labor Productivity

A measure of economic performance that compares the amount of goods and services produced (output) with the number of labor hours used to produce them.

Natural Resources

Materials or substances occurring in nature which can be exploited for economic gain, such as minerals, forests, and water bodies.

Rate Of Population Increase

The rate at which a population grows or declines, considering factors like birth rates, death rates, immigration, and emigration.

Q13: I donated 64 fluid ounces of blood

Q83: Round to the nearest thousandth: 4.4136<br>A)4.41<br>B)4.415<br>C)4.414<br>D)4.413

Q101: Kelly earned wages of $87,240, received $4814

Q119: You invest $11,000 in an account that

Q122: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3069/.jpg" alt=" A)Weak negative correlation

Q131: In 2013, the United States publicly held

Q147: Calculate the monthly payment and the portions

Q210: <span class="ql-formula" data-value="3,5,6,6,9,1"><span class="katex"><span class="katex-mathml"><math xmlns="http://www.w3.org/1998/Math/MathML"><semantics><mrow><mn>3</mn><mo separator="true">,</mo><mn>5</mn><mo

Q219: The monthly incomes of trainees at a

Q224: The table shows the country represented