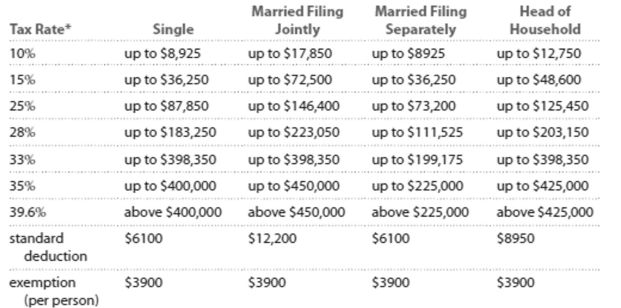

Solve the problem. Refer to the table if necessary.

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle-and high-income taxpayers.

-Tom and Toni are married and file jointly. Their combined wages were $78,148. They earned a net of $1593 from a rental property they own, and they received $1665 in interest. They claimed four

Exemptions for themselves and two children. They contributed $3364 to their tax-deferred

Retirement plans, and their itemized deductions total $10,516. Find their taxable income.

Definitions:

U.S. Trade Policy

It encompasses the laws, regulations, and practices that the United States uses to govern its trade with other countries, with the aim of protecting domestic industries, fostering economic growth, and promoting American interests abroad.

Tariffs

Taxes imposed on imported goods and services, intended to raise government revenue or protect domestic industries from foreign competition.

Trade Barriers

Measures implemented by countries to regulate or restrict international trade, including tariffs, quotas, and embargoes.

Fair Trade

A social movement aimed at helping producers in developing countries achieve better trading conditions and to promote sustainability.

Q24: I am young and I'm going to

Q32: The weekly salaries (in dollars)of 24

Q34: A single 31-year old man with a

Q86: A researcher finds a positive correlation between

Q107: 24 high school students were asked

Q108: Which of the statements below suggests an

Q110: <span class="ql-formula" data-value="496,598,503,528,565,601,576,543"><span class="katex"><span class="katex-mathml"><math xmlns="http://www.w3.org/1998/Math/MathML"><semantics><mrow><mn>496</mn><mo separator="true">,</mo><mn>598</mn><mo

Q118: Suppose that China's population policy is modified

Q166: Ken is head of household with a

Q192: Last week, Brian earned $355 while Lucy