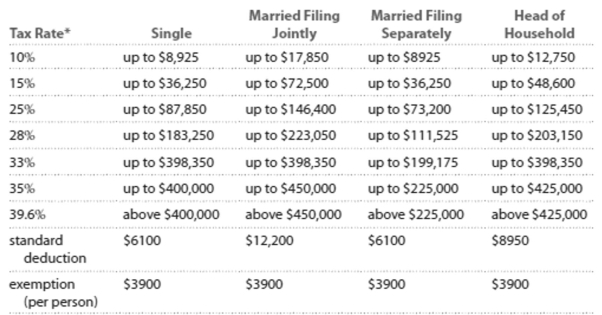

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductlons, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to \$36,250.

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle- and high-income taxpayers.

-Ken is head of household with a dependent child and a taxable income of $91,691. He also is entitled to a $1000 tax credit. Calculate the amount of tax owed.

Definitions:

Equal To Standard

Equal to standard implies that a process, product, or performance measures up to established benchmarks or criteria of quality and efficiency.

Planning

The process of setting objectives and determining how to accomplish them.

Control Process

The systematic effort within an organization to guide activities towards meeting goals and objectives, typically involving establishment, monitoring, and adjusting of standards.

Performance Objectives

Specific goals and targets set for employees or departments to achieve, linked to the overall strategic objectives of an organization.

Q62: A(n)_ deduction is the addition of all

Q68: What is the cost of lighting a

Q94: The heights of individuals in meters<br>A)Qualitative<br>B)Quantitative

Q97: In eighteen of the last twenty years

Q99: A researcher was interested in the exercise

Q126: 963 people voted for the incumbent candidate

Q145: <span class="ql-formula" data-value="0.5"><span class="katex"><span class="katex-mathml"><math xmlns="http://www.w3.org/1998/Math/MathML"><semantics><mrow><mn>0.5</mn></mrow><annotation encoding="application/x-tex">0.5</annotation></semantics></math></span><span

Q154: The following is a set of

Q158: A TV show announced that their survey

Q206: Caitlin is single and earned wages of