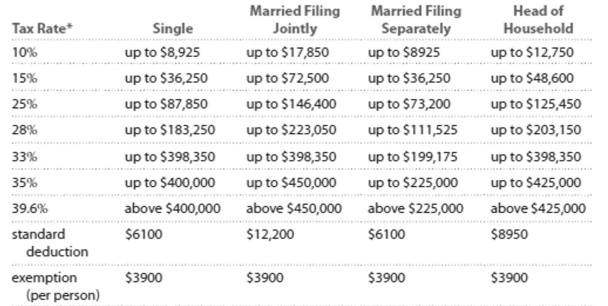

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductlons, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle-and high-income taxpayers.

-Bill earned wages of $47,227, received $1837 in interest from a savings account, and contributed $ 3010 to a tax deferred retirement plan. He was entitled to a personal exemption of $3900 and had

Deductions totaling $7719. Find his adjusted gross income.

Definitions:

Leading

The act of guiding and directing a group to meet its goals through influencing and motivating its members.

Upside-Down Pyramid

An organizational structure where decision-making is more decentralized and lower-level employees have more power and responsibilities.

Helping

Helping involves providing support or assistance to others, often to improve a situation or solve a problem, fostering a collaborative and supportive environment.

Supporting

The act of providing assistance or backing to individuals or groups, contributing to their success or wellbeing.

Q21: During the period 4000 BC to 1000

Q32: Your deductible expenditures $4146 for contributions to

Q70: Short-term capital gains are profits on items

Q90: <span class="ql-formula" data-value="A = \$ 96,000"><span class="katex"><span

Q146: A bank offers an APR of 2.4%

Q169: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3069/.jpg" alt=" A)Weak positive correlation

Q197: A meal in a restaurant cost $45

Q203: Find the scale ratio for a map

Q222: <span class="ql-formula" data-value="( x - 2 )

Q245: Scores on a test are normally distributed