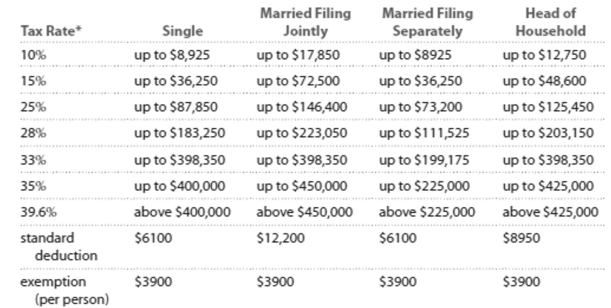

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductions, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle- and high-income taxpayers.

-Your deductible expenditures $4146 for contributions to charity and $635 for state income taxes. Your filing status entitles you to a standard deduction of $6100. Should you itemize your

Deductions rather than claiming the standard deduction? If so, what is the difference?

Definitions:

Health and Safety Complaints

Refers to issues or grievances raised by workers regarding potential hazards, unsafe working conditions or practices that could affect their health or safety at work.

Occupational Health

A field of healthcare and safety focused on preventing workplace injuries and illnesses through the promotion of healthy work environments.

Mental Health Problems

Conditions that affect a person's thinking, feeling, mood, or behavior, such as depression or anxiety, that may be occasional or long-lasting (chronic).

Work-family Conflict

The tension that arises when the demands of one's work and family roles are incompatible or interfere with each other.

Q6: A researcher randomly selects 300 adults from

Q25: Calculate the current yield for a $100

Q81: Which of the following pairs of variables

Q86: For women at Hartford College, times to

Q97: 8,099,140<br>A) <span class="ql-formula" data-value="8.09914 \times

Q133: <span class="ql-formula" data-value="10 ^ { 5 }

Q160: <span class="ql-formula" data-value="2 ^ { 3 }"><span

Q191: The table below gives information about

Q199: <span class="ql-formula" data-value="A = 18"><span class="katex"><span class="katex-mathml"><math

Q282: <span class="ql-formula" data-value="A = 3.1"><span class="katex"><span class="katex-mathml"><math