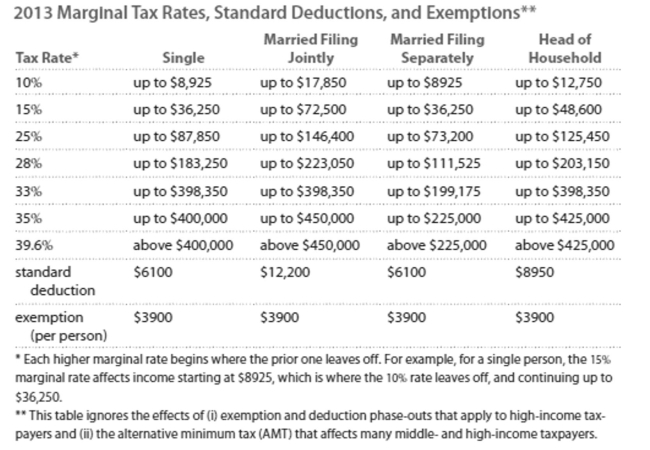

Solve the problem. Refer to the table if necessary.

-Jeff earned wages of $48,267, received $1837 in interest from a savings account, and contributed $ 3210 to a tax deferred retirement plan. He was entitled to a personal exemption of $3900 and had

Deductions totaling $7314. Find his taxable income.

Definitions:

Sales Adjusted

The net sales figure after deductions such as returns, allowances, and discounts have been accounted for.

Cash Basis

An accounting method that recognizes revenues and expenses only when cash is exchanged.

Cash Basis

An accounting method where revenues and expenses are recorded only when cash is received or paid, regardless of when the transactions occurred.

Cost of Goods Sold

The direct costs attributable to the production of the goods sold by a company, including the cost of the materials and labor used in creating the good.

Q21: Your true height is <span

Q68: A = 64.9 is the average number

Q68: What is the cost of lighting a

Q85: <span class="ql-formula" data-value="280 \mathrm {~K}"><span class="katex"><span class="katex-mathml"><math

Q134: Lengths of human pregnancies<br>A)Right-skewed<br>B)Left-skewed<br>C)Symmetric

Q194: Stephen earned $62,292 from wages as an

Q208: In which year was the value of

Q212: <span class="ql-formula" data-value="\left( 8.6 \times 10 ^

Q246: Determine how much of the total loan

Q249: The length of the room is 12