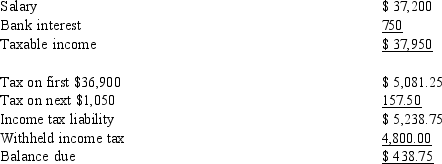

Barry has prepared the following 2014 income tax estimate for his sister, Sylvia. Sylvia is single, age 32, and has no children. Sylvia is an employee of General Motors and rents an apartment. Her only investment is a savings bank account.  Identify the errors, if any, in Barry's income tax estimate. Additional calculations are not required.

Identify the errors, if any, in Barry's income tax estimate. Additional calculations are not required.

Definitions:

Fragmentation

A method of asexual reproduction in some bacteria, archaea, animals, or plants; a cell or an organism separates into several pieces and each piece develops into a new organism.

Sporogenesis

The process of spore formation, particularly in plants, fungi, and protozoa.

Fission

The division of a single entity into two or more parts and the regeneration of those parts into separate entities resembling the original.

Budding

Asexual reproduction in which a small part of the parent’s body separates from the rest and develops into a new individual; characteristic of yeasts and certain other organisms.

Q1: Nonparametric methods are more sensitive than their

Q6: In a study of reaction times,

Q10: A biology professor claims that, on

Q30: In a multiple regression model

Q39: Nathan loans $50,000 to Ramona on January

Q57: Barry has prepared the following 2014 income

Q67: Ally served as chairperson of the local

Q76: The income tax treatment of damages received

Q113: Joan purchased her residence in 2011 for

Q129: Summary Problem: Tommy, a single taxpayer with