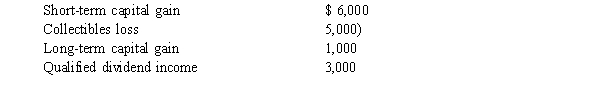

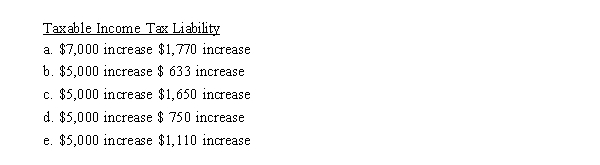

Sanderson has the following capital gains and losses and Qualified dividend income during the current year:  If Sanderson's marginal tax rate is 33%, what is the effect of these transactions on his taxable income and income tax liability?

If Sanderson's marginal tax rate is 33%, what is the effect of these transactions on his taxable income and income tax liability?

Definitions:

Capacity

In contract law, the legal ability to enter into a contractual relationship.

Voidable Presumption

A legal assumption that a contract or agreement can be invalidated or annulled based on certain circumstances, usually due to concerns like fraud or misrepresentation.

Nondisclosure Agreement

An agreement that requires employees to promise that, should they leave their employment with their present employer, they will not reveal any confidential trade secrets that they may learn at their current job.

Future Employment

Employment that is anticipated or planned to commence at a future date.

Q5: In 2007, Gaylord purchased 100 shares of

Q11: A correlation coefficient of <span

Q38: Alfred uses his personal automobile in his

Q47: Moonglow, Inc., purchases a group-term life insurance

Q54: The standard error of estimate is the

Q57: Matt, a U.S. citizen, can exclude all

Q84: Carl, age 59, and Cindy, age 49,

Q92: Jaun plans to give $5,000 to the

Q99: The marginal tax rate is the rate

Q118: Mei-Ling is a candidate for a master's