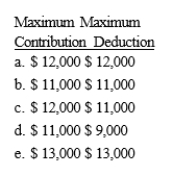

Carl, age 59, and Cindy, age 49, are married and file a joint return. During the current year, Carl had a salary of $41,000 and Cindy had a salary of $35,000. Both Carl and Cindy are covered by an employer-sponsored pension plan. Their adjusted gross income for the year is $94,000. Determine the maximum IRA contribution and deduction amounts.

Definitions:

Articles Of Incorporation

Legal documents filed with a government body to legally document the creation of a corporation.

Indenture Contract

A formal legal agreement, bond, or document specifying the terms and conditions between parties, often used in finance for bonds or loans.

Bylaws

Written rules and regulations that dictate how an organization or entity is governed and operated.

Q1: Garcia is single, 65 years old, and

Q4: Marci is single and her adjusted gross

Q11: Jerry recently graduates with an MBA degree

Q15: Gross selling price includes I. the amount

Q58: Lyle and Louise are retired living on

Q68: Natalie is the owner of an apartment

Q84: Which of the following taxes is deductible

Q103: LeRoy has the following capital gains and

Q113: Danielle graduated from State University in 2013.

Q126: Which of the following payments are currently