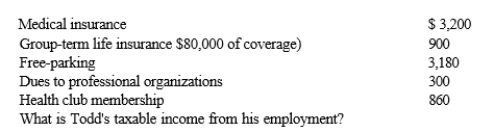

Todd, age 26 and single, is an employee of the Ice Corporation. Todd's annual salary is $50,000. Ice has a qualified pension into which employees may contribute 5% of their annual salary Todd contributes the maximum). The corporation also offers employees a flexible benefits plan. Todd pays $500 into the plan and is reimbursed for $500 of medical expenses not covered by his medical insurance. Ice also provides Todd with the following benefits:

Definitions:

Adjusting Entry

A journal entry made at the end of an accounting period to allocate income and expenditure to the appropriate years.

Contra Account

An account used in accounting to offset or reduce the balance of a related principal account.

Prepaid Expenses

Costs paid in advance for goods or services to be received in the future, which are recorded as assets until they are consumed.

Accrued Expenses

Expenses that have been incurred but not yet paid for, often recognized in the accounting period they are incurred.

Q1: When Rick found out that Ryan's liabilities

Q29: Travis is a 30% owner of 3

Q59: Karl has the following income loss) during

Q67: Determine the amount of gross income the

Q74: Melissa is a corporate sales representative for

Q99: Shasta has the following capital gains and

Q100: Arthur's employer establishes Health Savings Accounts HSAs)

Q109: Net collectibles gains are taxed at a

Q119: Boomtown Construction, Inc. enters into a contract

Q126: Laura and Jason are married and have