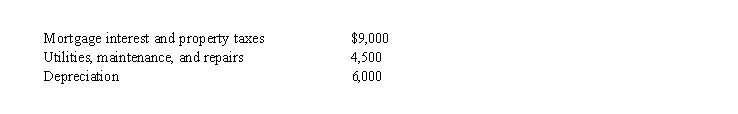

Marlene is a single taxpayer with an adjusted gross income of $140,000. In addition to her personal residence, Marlene owns a ski cabin in Vail. She uses the cabin for 40 days during the current year and rents it out to unrelated parties for 80 days, receiving rent of $10,000. Marlene's costs before any allocation related to the cabin are as follows:  Based on the above information, what is her allowable depreciation deduction?

Based on the above information, what is her allowable depreciation deduction?

Definitions:

Money Supply

The entirety of financial assets present in an economy at a given moment, encompassing cash, coins, and funds in checking and savings accounts.

Average Price Level

An index reflecting the overall direction and movement of prices within an economy, serving as an indicator of inflation or deflation over time.

Quantity Theory of Money

A theory stating that the general price level of goods and services is directly proportional to the amount of money in circulation.

Price Level

A measure of the average prices of goods and services in an economy at a given time, often used to gauge inflation.

Q1: The administrative convenience concept explains why some

Q5: Which of the following taxpayers can claim

Q17: Randolph borrows $100,000 from his uncle's bank

Q49: During 2013, Wendy, a biologist, made a

Q58: Dana is considering investing $20,000 in one

Q69: Mitaya purchased 500 shares of Sundown Inc.,

Q100: An individual can legally assign income to

Q107: An expense that is incurred for the

Q122: Generally income tax accounting methods are designed

Q124: Friendly Finance loans Anne $10,000 and she