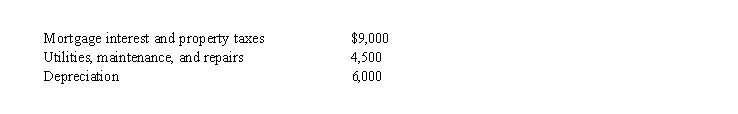

Marlene is a single taxpayer with an adjusted gross income of $140,000. In addition to her personal residence, Marlene owns a ski cabin in Vail. She uses the cabin for 40 days during the current year and rents it out to unrelated parties for 80 days, receiving rent of $10,000. Marlene's costs before any allocation related to the cabin are as follows:  Based on the above information, what is her allowable depreciation deduction?

Based on the above information, what is her allowable depreciation deduction?

Definitions:

Jensen's Measure

A performance evaluation measure that calculates the excess return a fund generates over its expected return, given its level of risk.

Risk-Free Return

The theoretical return on an investment with no risk of financial loss, often represented by the yield on government securities such as U.S. Treasury bonds.

Beta

A measure of a security's volatility in relation to the overall market; a beta greater than 1 indicates greater volatility than the market.

Bogey Portfolio

A benchmark portfolio against which the performance of an investment portfolio is measured, often used to assess the skill of portfolio managers.

Q3: Lynnette is a single individual who receives

Q15: Which of the following business expenses is/are

Q40: Christine, age 23, is an employee of

Q46: The split basis rule for determining the

Q50: Which of the following individuals is involved

Q83: The cash method of accounting for income

Q114: Cindy is an employee of Silvertone Corporation.

Q119: An ordinary expense I. is normal, common,

Q121: During 2014, Myca sells her car for

Q125: Which of the following individuals can be