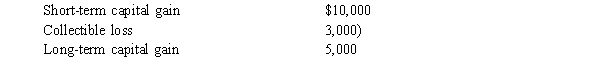

LeRoy has the following capital gains and losses for the current year:  If LeRoy is single and has taxable income from other sources of $52,000, what is the tax on his capital gains?

If LeRoy is single and has taxable income from other sources of $52,000, what is the tax on his capital gains?

Definitions:

Synarthrotic Joints

A type of joint that allows for little or no movement, typically found where bones are fused together, such as in the skull.

Synovial Joints

Freely movable joints in the body, characterized by a cavity filled with synovial fluid, which lubricates and nourishes the joint.

Cartilaginous Joints

Joints where the bones are connected by cartilage, allowing for only slight movement, as found between the vertebrae in the spine.

Synchondroses

A type of cartilaginous joint where bones are joined together by hyaline cartilage, allowing for growth or slight mobility.

Q16: Tien purchases an office building for $400,000,

Q18: Paul, age 40 and single, has an

Q24: Paris is a CPA and a partner

Q29: Travis is a 30% owner of 3

Q37: Charlotte purchases a residence for $105,000 on

Q62: On March 11, 2012, Carlson Corporation granted

Q67: Martina, an unmarried individual with no dependents,

Q69: Does the selection of a corporate entity

Q88: Which of the following is/are correct regarding

Q113: Carey and Corrine are married and have