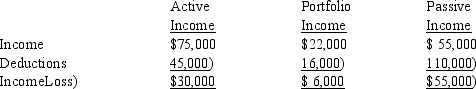

If a taxpayer has the following for the current year:  I. If the taxpayer is a regular corporation, taxable income from the three activities is a loss of $19,000. II. If the taxpayer is an individual and the passive income is related to a rental real estate activity in which the taxpayer is an active participant, taxable income is $11,000.

I. If the taxpayer is a regular corporation, taxable income from the three activities is a loss of $19,000. II. If the taxpayer is an individual and the passive income is related to a rental real estate activity in which the taxpayer is an active participant, taxable income is $11,000.

Definitions:

Variable Manufacturing Overhead

Costs that vary proportionally with manufacturing activity, such as indirect materials and utilities.

Markup

The amount added to the cost of goods to cover operating expenses and profit, expressed as a percentage of cost.

Direct Labor-Hours

Direct labor-hours refer to the total hours worked by employees directly involved in the production process, used as a basis for allocating labor costs to products.

Machine-Hours

The total hours that machinery is operated during a specific period for production purposes.

Q8: Melonie purchased 100 shares of Wake Corporation

Q18: Paul, age 40 and single, has an

Q24: Simon Leasing, Inc., an accrual basis taxpayer,

Q25: Amy borrowed $25,000 for her business from

Q44: On February 3 of the current year,

Q64: Ricardo owns interests in 3 passive activities:

Q72: Mark and Cindy are married with salaries

Q81: Lindale Rentals places an apartment building in

Q110: Income tax accounting methods and financial accounting

Q123: Mollie is single and is an employee