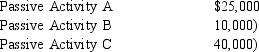

Loren owns three passive activities that had the following results for the current year:  If none of the passive activities are rental real estate activities, what is the amount of suspended loss attributable to Activity C?

If none of the passive activities are rental real estate activities, what is the amount of suspended loss attributable to Activity C?

Definitions:

Health

A state of complete physical, mental, and social well-being.

Canada's Health Act

Legislation that sets the framework for the provision of universal health care in Canada, emphasizing public administration, comprehensiveness, universality, portability, and accessibility.

Disabilities

Physical or mental conditions that limit a person's movements, senses, or activities, often requiring accommodations for full participation in society.

Daily Living

Activities and tasks that are performed regularly by an individual in the course of a normal day, including basic self-care, work, and leisure activities.

Q21: Which of the following factors absolutely must

Q26: A taxpayer can take a deduction for

Q33: Wilson Corporation purchases a factory building on

Q47: Darien owns a passive activity that has

Q50: Buffey operates a delivery service. She purchased

Q81: Thomas has adjusted gross income of $228,000,

Q90: Melinda and Riley are married taxpayers. During

Q102: Jerry's wife dies in September. His wife

Q115: For purposes of the relationship test for

Q136: Marlene is a single taxpayer with an