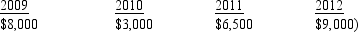

Billingsworth Corporation has the following net capital gains and losses for 2009 through 2012. Billingsworth' marginal tax rate is 34% for all years.  In 2013, Billingsworth Corporation earned net operating income of $30,000. What is/are the tax effects) of the $9,000 net capital loss in 2012? I. Corporate taxable income is $21,000. II. The net capital loss will provide income tax refunds totaling $3,060. Only statement I is correct. Only statement II is correct. Both statements are correct. Neither statement is correct.

In 2013, Billingsworth Corporation earned net operating income of $30,000. What is/are the tax effects) of the $9,000 net capital loss in 2012? I. Corporate taxable income is $21,000. II. The net capital loss will provide income tax refunds totaling $3,060. Only statement I is correct. Only statement II is correct. Both statements are correct. Neither statement is correct.

Definitions:

Sustainable Innovation

The development of new products, processes, or services that meet current needs without compromising the ability of future generations to meet their own needs, often with a focus on environmental sustainability.

Quarterly Earnings

A report of a company's financial performance, including revenue and profit, issued every three months.

Resource Constraints

Limitations in the availability of resources such as finances, materials, and human capital that can affect an organization's ability to achieve its goals.

Short-termism

A mindset or approach prioritizing short-term gains over long-term goals and strategies.

Q2: Ally served as chairperson of the local

Q3: Todd, age 26 and single, is an

Q24: A limitation exists on the annual amount

Q31: Matt has a substantial portfolio of securities.

Q31: Why might a taxpayer elect to depreciate

Q38: The accrual method I. is permitted for

Q76: During the current year, Diane disposes of

Q88: A taxpayer can deduct multiple gifts to

Q101: Fred and Irma are married with salaries

Q121: Which of the following tax rates applies