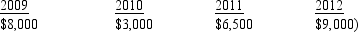

Billingsworth Corporation has the following net capital gains and losses for 2009 through 2012. Billingsworth' marginal tax rate is 34% for all years.  In 2013, Billingsworth Corporation earned net operating income of $30,000. What is/are the tax effects) of the $9,000 net capital loss in 2012? I. Corporate taxable income is $21,000. II. The net capital loss will provide income tax refunds totaling $3,060. Only statement I is correct. Only statement II is correct. Both statements are correct. Neither statement is correct.

In 2013, Billingsworth Corporation earned net operating income of $30,000. What is/are the tax effects) of the $9,000 net capital loss in 2012? I. Corporate taxable income is $21,000. II. The net capital loss will provide income tax refunds totaling $3,060. Only statement I is correct. Only statement II is correct. Both statements are correct. Neither statement is correct.

Definitions:

AGVs

Automated Guided Vehicles; robotic vehicles used for transporting materials around a manufacturing facility, warehouse, or other environments without direct human intervention.

CNC

Acronym for Computer Numerical Control, a process used in manufacturing that involves the use of computers to control machine tools.

Computer-Integrated Manufacturing

A system of manufacturing in which the entire production process is controlled by computer, from the initial design and manufacturing of the product to its final delivery.

Flexible Manufacturing System

An approach to manufacturing that allows for the easy adaptation of processes and machines to make different products or parts.

Q12: James rents his vacation home for 30

Q30: On June 1, 2014, AZ Construction Corporation

Q64: The Section 179 expense deduction is allowed

Q67: Mark has an adjusted gross income of

Q72: Mark and Cindy are married with salaries

Q101: Discuss whether the following persons are currently

Q103: On May 1, 2014, Linda sells her

Q107: Punitive damage awards received because of a

Q108: Rosa is a single parent who maintains

Q113: Danielle graduated from State University in 2013.