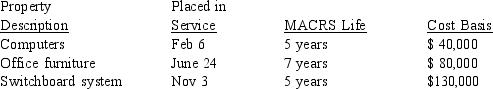

The Ross CPA Firm places the following property in service during the 2014 tax year:  Ross wants to obtain the maximum possible depreciation deduction for these property acquisitions including full utilization of the election to expense property under Section 179. Ross will report 2014 taxable income in the amount of $20,000 before consideration of depreciation on their 2014 property acquisitions. What is Ross' maximum depreciation from these additions?

Ross wants to obtain the maximum possible depreciation deduction for these property acquisitions including full utilization of the election to expense property under Section 179. Ross will report 2014 taxable income in the amount of $20,000 before consideration of depreciation on their 2014 property acquisitions. What is Ross' maximum depreciation from these additions?

Definitions:

Narcotic Antagonist

A medication that blocks or reverses the effects of opioids.

Endorphin Receptor Sites

Specific areas on cell surfaces that bind endorphins, leading to pain relief and feelings of pleasure.

Agonist Drugs

Substances that activate neurotransmitter receptors to produce a biological response, often mimicking the action of naturally occurring substances.

Detoxifiers

Substances or processes that remove toxins from the body, often used in the context of substance abuse recovery.

Q3: Billingsworth Corporation has the following net capital

Q6: Virginia is the sole shareholder in Barnes

Q8: Discuss the general differences between Section 1245

Q26: Withdrawals of cash by a partner are

Q31: Matt has a substantial portfolio of securities.

Q32: During the current year, Terry has a

Q44: Calvin Corporation, has the following items of

Q72: Which of the following correctly describes) cost

Q82: Kenzie and Ross equally own rental real

Q82: Discuss the characteristics of a personal service