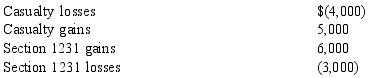

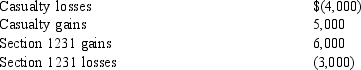

Pidgeon, Inc. has the following gains and losses from Section 1231 property during 2014:

No net Section 1231 losses have been deducted as ordinary losses in prior years. How much of the 2014 Section 1231 gains and losses are recognized as long-term capital gains?

No net Section 1231 losses have been deducted as ordinary losses in prior years. How much of the 2014 Section 1231 gains and losses are recognized as long-term capital gains?

Definitions:

Space Study Time

The planned and structured periods dedicated to the study and exploration of outer space.

Rereading

An often-used study technique involving going through the same material multiple times to improve memory and comprehension.

Lecture Notes

Written reminders or points taken during a lecture to aid memory and understanding of the presented material.

Cram

The act of studying intensively over a short period of time just before an examination.

Q1: Qualified Section 179 property for a retail

Q1: Carlota owns 4% of Express Corporation and

Q11: Ralph buys a new truck 5-year MACRS

Q14: Leonor is the financial vice-president and owns

Q29: Craig Corporation realizes $150,000 from sales during

Q32: MACRS eliminates several sources of potential conflict

Q43: Lydia purchased a sapphire bracelet for $3,000

Q50: Rosilyn trades her old business-use luxury car

Q50: The Baskerville Corporation has a net $6,500

Q62: Moran pays the following expenses during the