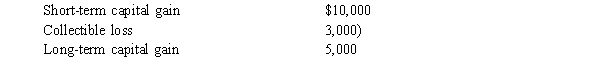

LeRoy has the following capital gains and losses for the current year:  If LeRoy is single and has taxable income from other sources of $52,000, what is the tax on his capital gains?

If LeRoy is single and has taxable income from other sources of $52,000, what is the tax on his capital gains?

Definitions:

Single Individual

Refers to one person, often in contexts emphasizing the role or impact of just one member within a larger group or system.

Closed Receivership

A legal process where a court appoints a receiver to manage the affairs of a financially troubled company, with the aim of paying off its debts.

Corporate Governance

The set of rules, practices, and processes used to direct and manage a corporation, aiming to balance the interests of various stakeholders.

Bylaws

The set of rules and regulations that govern the internal management of an organization or corporation.

Q4: Marci is single and her adjusted gross

Q31: Cornell and Joe are equal partners in

Q33: Rosalee has the following capital gains and

Q43: COMPREHENSIVE TAX CALCULATION PROBLEM. Girardo and Gloria

Q52: During the current year, Robbie and Anne

Q53: Unrecaptured Section 1250 gain I. is subject

Q66: Victor is single and graduated from Wabash

Q70: Contributions to a Roth IRA: I. May

Q76: A taxpayer must begin withdrawals from any

Q76: Sarah exchanges investment real estate with Russell.