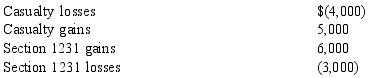

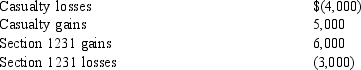

Pidgeon, Inc. has the following gains and losses from Section 1231 property during 2014:

No net Section 1231 losses have been deducted as ordinary losses in prior years. How much of the 2014 Section 1231 gains and losses are recognized as long-term capital gains?

No net Section 1231 losses have been deducted as ordinary losses in prior years. How much of the 2014 Section 1231 gains and losses are recognized as long-term capital gains?

Definitions:

Decision-making Skills

The ability to select between two or more alternatives to reach the best outcome in the shortest time.

Monitoring Behavior

Observing and checking the progress or quality of (someone's or something's) actions over a period of time.

Parent-child Relationship

The dynamic and interpersonal connection between a parent and their child, characterized by varying degrees of love, conflict, care, and communication.

Adolescence

The transitional stage of physical and psychological development that generally occurs during the period from puberty to legal adulthood.

Q8: Frasier sells some stock he purchased several

Q20: All of the following are advantages of

Q29: Travis is a 30% owner of 3

Q32: Sidney, a single taxpayer, has taxable income

Q43: Sophia purchases a completely furnished condominium in

Q59: Karl has the following income loss) during

Q66: Karen owns a commercial office building with

Q67: Adjusted basis is equal to the initial

Q82: Which of the following best describes the

Q100: Under the computation of the alternative minimum