Mario is a real estate and financial consultant who owns and operates his own business as a sole proprietor. His adjusted gross income, excluding the items below is $48,000. The following information relates to his current year activities and income tax.

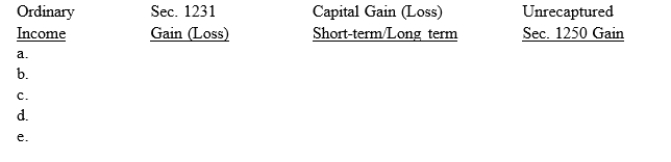

a. Land adjacent to his office was purchased during 2014 for an anticipated expansion. It cost $10,000 but was sold later in the year for $17,000.

His office building is sold for $250,000 in anticipation of moving to a different location. The

b. building was purchased in 1994 for $200,000 with 10% of the cost allocated to the land.

Depreciation taken on the building was $100,000.

c. Office furniture that cost $20,000 and was fully depreciated is sold for $6,000.

A color copier purchased two years ago for $50,000 is traded for 200 shares of Microsoft

d. stock that were worth $24,000 on the date of the exchange. The copier had a basis to Mario of $35,000 but is worth only $24,000 on the date of the exchange.

e. Mario's automobile, which he used 100% for business and had cost him $18,000 in 2010 is sold for $8,000. Depreciation of $6,000 had been taken on the automobile.

REQUIRED: Fill in the following table by listing the amount and proper treatment of the recognized gain or loss from each of the above transactions. Identify by letter a-e.

What is Mario's net Capital Gain Loss) for the current year?

Definitions:

Noncontroversial Issues

Noncontroversial issues refer to topics or matters that generally do not evoke strong disagreements or opposition, often allowing for easier consensus or discussion.

Lean Production

An approach to manufacturing that emphasizes reducing waste and improving efficiency and quality in the production process.

Taylorism

A management theory developed by F.W. Taylor, emphasizing scientific analysis of workflows to improve economic efficiency, especially labor productivity.

Cooperative Management

A management style that emphasizes collaboration, shared decision-making, and democratic practices in an organization.

Q3: Billingsworth Corporation has the following net capital

Q7: Watson Company purchases used equipment 5-year MACRS

Q24: Amanda is an employee of the Kiwi

Q50: Harry sells an apartment building for $117,000.

Q53: Rationale for nonrecognition of property transactions exists

Q55: Sammy buys a 20% interest in Duvall

Q62: The IRS may acquiesce or nonacquiesce to

Q79: Concerning individual retirement accounts IRAs), I. A

Q89: Personal Service Corporations PSCs) have certain special

Q94: On October 2, 2014, Miriam sells 1,000