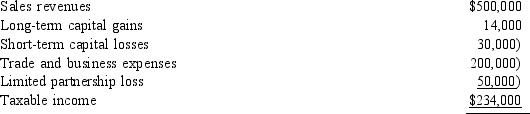

Cornell and Joe are equal partners in Jones Company. For the current year, Jones reports the following items of income and expense:  In addition to his Jones earnings, Joe has other net taxable income of $45,000. Included in the $45,000 is $10,000 in income from a passive activity. Joe's income is:

In addition to his Jones earnings, Joe has other net taxable income of $45,000. Included in the $45,000 is $10,000 in income from a passive activity. Joe's income is:

Definitions:

Operating Expenses

Costs associated with the day-to-day operations of a business, excluding cost of goods sold, taxes, and interest expenses.

Noncontrolling Interest

A minority stake in a company that is not large enough to exert control over its policies or operations, often found in consolidated financial statements.

Intra-entity Transfer

Transactions of assets, services, or funds between divisions, departments, or affiliated entities within the same parent organization.

Q16: Brent purchases a new warehouse building on

Q21: The t distribution can be used when

Q27: If you flip a coin three times,

Q50: On January 5, 2014, Mike acquires a

Q55: All of the gain from the sale

Q65: Terry receives investment property from her mother

Q73: Determine the proper classifications) of the asset

Q74: Start-up and organizational costs can be expensed

Q83: Foster owns 27% of the Baxter Corporation,

Q97: The amount realized equals the gross selling