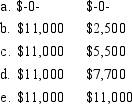

Isabelle and Marshall are married with salaries of $50,000 and $45,000, respectively. Adjusted gross income on their jointly filed tax return is $102,000. Both individuals are active participants in employer provided qualified pension plans. What are Isabelle and Marshall's maximum combined IRA contribution and deduction amounts? Contribution Deduction

Definitions:

Heart Disease

A range of conditions that affect the heart, including coronary artery disease, heart attacks, congestive heart failure, and congenital heart defects.

Lesson Plan

A detailed outline of the objectives, activities, and assessments planned for a particular teaching session or educational course.

Nutrition Counselors

Professionals who provide guidance and advice on eating habits and nutrition for health and wellness.

Nutrition Education Intervention

A program designed to improve nutritional knowledge and healthful eating behaviors among specific populations.

Q10: A two-tailed test is conducted at the

Q23: Tossing two tails with two fair coins<br>A)

Q27: A fire destroyed Jimmy's Teeshirt Shop. The

Q31: Kathy and Patrick are married with salaries

Q32: Scores on a particular test have a

Q40: A qualified distribution from a Roth IRA

Q42: Cathy owns property subject to a mortgage

Q74: A taxable entity has the following capital

Q81: Dontrell sells a building used in his

Q89: Personal Service Corporations PSCs) have certain special