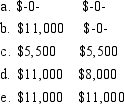

Kathy and Patrick are married with salaries of $28,000 and $21,000, respectively. Adjusted gross income on their jointly filed tax return is $54,000. Both individuals are active participants in employer provided qualified pension plans. What are Kathy and Patrick's maximum combined IRA contribution and deduction amounts? Contribution Deduction

Definitions:

Negotiable Instrument

An instrument in writing that, when transferred in good faith and for value without notice of defects, passes a good title to the instrument to the transferee.

Contract of Carriage

An agreement between a carrier and a shipper for the transport of goods or passengers.

Title Document

Legal paperwork that proves ownership of a particular asset, such as real estate or a vehicle.

Special Import Measures Act

Legislation aimed at providing protection to Canadian industries against unfair trade practices such as dumping and subsidization by foreign companies.

Q2: "Recapture of depreciation" refers to:<br>A) Downward adjustments

Q11: During 2014, Jimmy incorporates his data processing

Q18: The analysis of the data in

Q20: The grocery expenses for six families were

Q32: Sidney, a single taxpayer, has taxable income

Q50: A study of two types of weed

Q60: The owner of a football team claims

Q62: On March 11, 2012, Carlson Corporation granted

Q87: On February 19, 2012, Woodbridge Corporation granted

Q97: Which of the following would not be