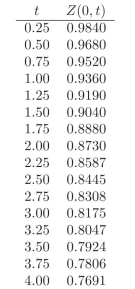

Use the following discount factors when needed.

-Calculate the duration of the following portfolio:

i. 3 units of a 0.75-year ?xed rate bond paying 6% quarterly.

ii. 4 units of a 2-year ?xed rate bond paying 3% semiannually.

iii. 7 units of a 1.75-year zero coupon bond.

iv. 1 unit of a 2-year ?oating rate bond with no spread paid semiannually.

Definitions:

Ethical Decision-Making Framework

A systematic approach to resolving ethical dilemmas in business, considering moral principles and stakeholder impacts.

Exaggerate Earnings

The act of overstating income or profits, often to mislead stakeholders or inflate a company's value.

Ethical Decision-Making Metric

A tool or standard used to guide and evaluate decisions based on moral principles and ethical values.

Strategic Marketing Planning Process

A systematic approach for developing marketing strategies that align with the overarching goals of an organization, involving situation analysis, goal setting, and tactical planning.

Q2: <span class="ql-formula" data-value="f ( x ) =

Q6: In many cases, traditional, volume based product

Q13: What do we need to build in

Q13: If short term rates go up, what

Q17: Is the price obtained from Monte Carlos

Q46: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB34225555/.jpg" alt=" A)

Q50: When determining the markup to be used

Q54: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2705/.jpg" alt=" A)

Q147: <span class="ql-formula" data-value="- 3 \leq \frac {

Q156: The paired data below consist of