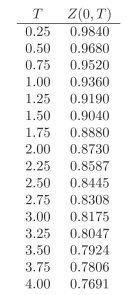

Use the following discount factors when needed.

-Calculate the convexity of the following portfolio:

i. 2 units of a 1.5-year ?xed rate bond paying 6% quarterly.

ii. 4 units of a 1.75-year ?oating rate bond paying ?oat + 80 bps semi- annually. You know that the reference rate was 7% three months ago. 13

iii. 6 units of a 2-year zero coupon bond.

iv. 1 units of a 1.5-year ?oating rate bond with no spread paid semian- nually.

Definitions:

Q4: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2705/.jpg" alt=" A)

Q6: The weight of a liquid varies directly

Q15: What advantages do Monte Carlo simulatons on

Q40: A profitability index can be used to

Q44: The curve that shows the relationship between

Q54: What price must Longwood charge if the

Q98: Racer Industries is currently purchasing Part No.

Q128: 7x +9 y=80 <br>A) <span

Q143: <span class="ql-formula" data-value="f ( x ) =

Q153: <span class="ql-formula" data-value="f ( x ) =