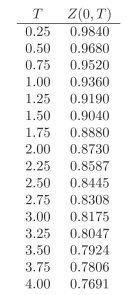

Use the following discount factors when needed.

-Calculate the convexity of the following portfolio:

i. 1 unit of a 2-year ?xed coupon bond paying 10% coupon quarterly.

ii. 1 unit of a 2-year ?xed coupon bond paying 1% coupon semiannually.

iii. 1 unit of a 2-year zero coupon bond.

Definitions:

Normal Curve

The normal curve, or the bell curve, represents the graphical depiction of a normal distribution with a symmetric shape where most outcomes cluster around the mean.

Standard Deviation

A measurement indicating the range of separation or variance among a set of data.

Mean

The arithmetic average of a set of numbers, calculated by adding all the numbers and dividing by the count.

Standard Normal Curve

A bell-shaped curve that is symmetric about the mean, showing the distribution of a standard normal variable where the mean is zero and the standard deviation is one.

Q8: If market participants don't expect yield to

Q8: How can we obtain ? in order

Q14: Compute the spot rate duration for a

Q14: f(x)= 18 + x<br>A)-18<br>B)1<br>C)18<br>D)181

Q21: Rudy Enterprises currently sells a piece of

Q24: <span class="ql-formula" data-value="f ( x ) =

Q60: <span class="ql-formula" data-value="\begin{array} { r | r

Q103: The following data pertain to Ronaldo Enterprises:<br><img

Q109: <span class="ql-formula" data-value="f ( x ) =

Q114: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB34225555/.jpg" alt=" A) y-axis B)