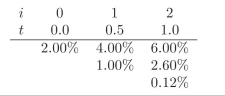

You are given the following interest rate tree. Use it when required in the

exercises.

-Using risk neutral pricing obtain the value for a call option on a 1.5 year zero coupon bond with K = 99.00, maturity at t = 1. Assume that p? = 0.7038 is constant over time.

Definitions:

Clinic

A healthcare facility that provides outpatient medical treatment.

Marginal Distribution

The probability distribution of a subset of a collection of random variables, ignoring the presence of other variables.

Automobiles

Motor vehicles with wheels that are designed for operation on roads and to transport people.

Region of Origin

The geographic area or location where something or someone comes from or is considered to have started.

Q2: What problem does the "delta" approximation have?

Q8: How can we obtain ? in order

Q11: Calculate the convexity of the following portfolio:

Q24: The payback period is best defined as:<br>A)

Q64: (9,-4),(13,-4),(13,3) <br>A) Yes<br>B) No

Q75: Flagler Electronics currently sells a camera for

Q90: When benefits are difficult to quantify in

Q102: 2(x+3)=3-4(x+3)<br>A) <span class="ql-formula" data-value="\frac {

Q151: <span class="ql-formula" data-value="f ( x ) =

Q168: <span class="ql-formula" data-value="f ( x ) =