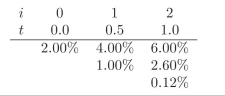

You are given the following interest rate tree. Use it when required in the

exercises.

-Using risk neutral pricing obtain the value for a put option on a 1.5 year zero coupon bond with K = 97.40, maturity at t = 1. Assume that p? = 0.7038 is constant over time.

Definitions:

Obese

A medical condition characterized by excessive body fat accumulation that presents a risk to health, typically measured by body mass index (BMI).

Obesity Rate

A statistical measure that reflects the proportion of a population that is significantly overweight, as a marker of the public health issue of obesity.

Hypothalamus

A region of the brain below the thalamus that coordinates both the autonomic nervous system and the activity of the pituitary, controlling body temperature, hunger, and thirst, among other processes.

Lorcaserin

A medication used for weight management in adults, operating by suppressing appetite through the activation of serotonin receptors in the brain.

Q1: Why is it useful to price Mortgage

Q4: What is a Partial Differential Equation (PDE)?

Q7: Compute the Term Spread and the Butter?y

Q12: What is a European Call option?

Q13: A graph of a function g is

Q48: At which step or steps in the

Q53: Marker Sail Company plans to purchase $4.5

Q61: <span class="ql-formula" data-value="f ( x ) =

Q84: An advantage of the NPV method is

Q111: The shape of <span class="ql-formula"