Randi Corp. is considering the replacement of some machinery that has zero book value and a current market value of $2,800. One possible alternative is to invest in new machinery that costs $30,000. The new equipment has a four-year service life and an estimated salvage value of $3,500, will produce annual cash operating savings of $9,400, and will require a $2,200 overhaul in year 3. The company uses straight-line depreciation.

Required:

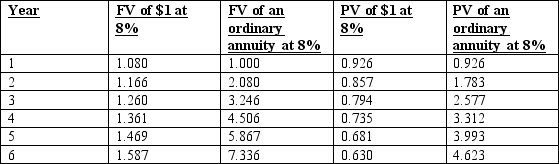

Prepare a net-present-value analysis of Randi’s replacement decision, assuming an 8% hurdle rate and no income taxes. Should the machinery be acquired? Note: Round calculations to the nearest dollar.

Definitions:

Sustainable Growth Rate

The maximum rate at which a company can grow its revenues without needing to increase its financial leverage.

Shareholders' Equity

The residual interest in the assets of a corporation that remains after deducting its liabilities, representing the owners' claim on the business.

Net Income

The total profit of a company after all expenses and taxes have been deducted from gross income.

Dividends Paid

The total amount of dividends that a corporation has paid out to its shareholders during a specific period, typically expressed on a per share basis.

Q3: What factors explain long term yields?

Q9: What is the Fed's mandate?

Q12: Price the previous mortgage, assuming that the

Q12: For the Vasicek model can we say

Q17: When pricing options under the Hull-White, what

Q28: Information is said to be useful in

Q44: The true economic yield produced by an

Q64: Income divided by sales revenue is called

Q90: Disregard the information in the previous question.

Q101: Consider the following statements about time and