On January 2, 20x1, Jennifer Grey purchased 800 shares of Sounder Telecommunications common stock at $35 per share. The company paid a $1.50 dividend per share on December 28 of that year, and raised the amount by $0.50 per share for a distribution on December 28, 20x2. Jennifer sold her entire investment on December 30, 20x2, generating a $5,000 gain on the sale of stock.

Required:

A. Prepare a dated listing of the cash inflows and outflows related to Jennifer's stock investment. Ignore income taxes.

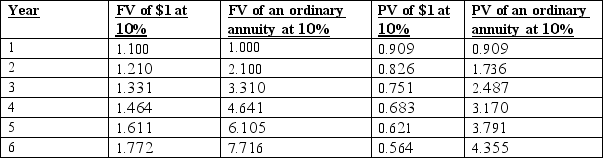

B. Assume that Jennifer has a 10% hurdle rate for all investments. Rounding to the nearest dollar, compute the net present value of her investment in Sounder and determine whether she achieved her 10% goal.

Definitions:

Bicarbonate

An alkaline compound with buffering properties, helping to maintain pH balance in various body fluids.

Hereditary Spherocytosis

A genetic condition causing red blood cells to be spherical and fragile, leading to hemolytic anemia.

Prothrombin Time

A blood test that measures how quickly blood clots, used to monitor blood thinning medications.

Abnormal Hemoglobin

Variants of hemoglobin differing from the normal composition, which can affect oxygen transport and lead to conditions such as sickle cell anemia.

Q1: What use does the Replicating Portfolio have?

Q2: You notice that when no lockout period

Q10: If the transfer price is set at

Q13: What advantage does the Ho-Lee model hold

Q28: Bowers Company plans to incur $190,000 of

Q43: Grand's Auto Northern Division is currently purchasing

Q59: Which of the following is not a

Q70: Jamison Company had sales revenue and operating

Q70: Which of the following would not be

Q94: Consider the following statements about pricing:<br>I. Prices