Tanner Corporation is considering the acquisition of a new machine that is expected to produce annual savings in cash operating costs of $30,000 before income taxes. The machine costs $100,000, has a useful life of five years, and no salvage value. Tanner uses straight-line depreciation on all assets, is subject to a 30% income tax rate, and has an after-tax hurdle rate of 8%.

Required:

A. Compute the machine's accounting rate of return on the initial investment.

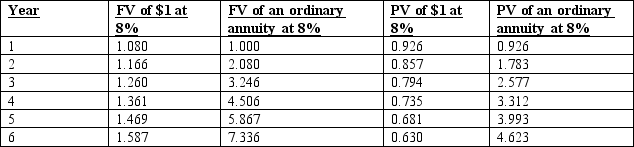

B. Compute the machine's net present value.

Definitions:

Fixed Costs

Expenses that are constant in total, regardless of changes in the volume of activity within a relevant period.

Total Fixed Cost

Total fixed cost is an accounting term describing the sum of all expenses within a company that do not change with the level of production or sales, such as rent, salaries, and insurance.

Variable Cost Per Unit

A cost that changes with the level of output or sales, directly proportional to the amount of goods or services produced.

Earnings Before Interest And Taxes

Also known as EBIT, it measures a company's profitability before deducting interest and income tax expenses.

Q4: For the following scenario, check if there

Q10: What is the main drawback for log-normal

Q11: What is the swaptions implied volatility?

Q14: Compute the spot rate duration for a

Q18: Foxmoor Corporation uses an imputed interest rate

Q28: A profit center manager:<br>A) does not have

Q38: Which of the following terms describes a

Q57: Costs that are traceable to a segment

Q86: The performance reports generated by a responsibility

Q184: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB34225555/.jpg" alt=" A)