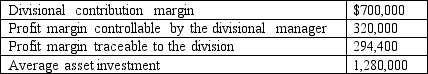

The following data pertain to the Ouster Division of Klandestine Company:

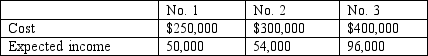

The company uses responsibility accounting concepts when evaluating performance; Ouster's division manager is contemplating the following three investments. He can invest up to $400,000.

Required:

A. Calculate the ROIs of the three investments.

B. What is the division manager's current ROI, computed by using responsibility accounting concepts?

C. Which of the three investments would be selected if the manager's focus is on Ouster's divisional performance, as judged by ROI? Why?

D. If Klandestine has an imputed interest charge of 22%, compute the residual income of investment no. 3. If Ouster's Division manager is evaluated by residual income, is this investment attractive from Ouster's perspective? From Klandestine's perspective? Why?

Definitions:

Standard Deviation

A metric that calculates the extent of variation or spread in a data set.

Standard Deviation

An indicator of the diversity or spread in a dataset, indicating how much individual data points deviate from the mean value.

Standard Deviation

An index quantifying how much data values spread out or differ from each other.

Standard Deviation

An indicator of the degree of spread or variability within a dataset, showing how significantly the values deviate from the average.

Q11: In what aspect is the Hull-White model

Q15: What is the source of flat volatility?

Q30: The cost of inventory currently owned by

Q31: Consider the following statements about the accounting

Q36: Quinton Company has set the following standards

Q44: The curve that shows the relationship between

Q66: Jared, Inc. produces glass shelves that are

Q70: Jamison Company had sales revenue and operating

Q73: In an effort to reduce record-keeping, companies

Q85: What practice best describes when divisional managers