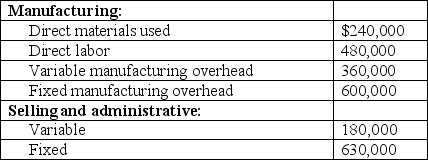

Vero, Inc. began operations at the start of the current year, having a production target of 60,000 units. Actual production totaled 60,000 units, and the company sold 95% of its manufacturing output at $50 per unit. The following costs were incurred:

Required:

A. Assuming the use of variable costing, compute the cost of Vero's ending finished-goods inventory.

B. Compute the company's contribution margin. Would Vero disclose the contribution margin on a variable-costing income statement or an absorption-costing income statement?

C. Assuming the use of absorption costing, how much fixed selling and administrative cost would Vero include in the ending finished-goods inventory?

D. Compute the company's gross margin.

Definitions:

Q21: All of the following are expensed under

Q24: <br>If these data are based on the

Q34: Manufacturing overhead:<br>A) includes direct materials, indirect materials,

Q34: At a volume of 20,000 units, Almount

Q49: Using the weighted-average method of process costing,

Q57: When using normal costing, the total production

Q60: A complete financial planning and analysis (FP&A)

Q72: Prevlar's budget for variable overhead and fixed

Q83: Due to evaporation during production, X-treme Building

Q88: Charger Industries currently assigns overhead to products