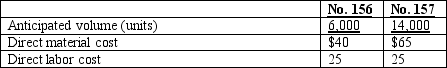

Private Corporation manufactures two types of transponders-no. 156 and no. 157-and applies manufacturing overhead to all units at the rate of $76.50 per machine hour. Production information follows.

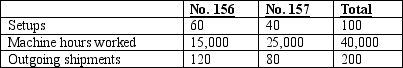

The controller, who is studying the use of activity-based costing, has determined that the firm's overhead can be identified with three activities: manufacturing setups, machine processing, and product shipping. Data on the number of setups, machine hours worked, and outgoing shipments, the activities' three respective cost drivers, follow.

The firm's total overhead of $3,060,000 is subdivided as follows: manufacturing setups, $260,000; machine processing, $2,400,000; and product shipping, $400,000.

Required:

A. Compute the pool rates that would be used for manufacturing setups, machine processing, and product shipping in an activity-based costing system.

B. Assuming use of activity-based costing, compute the unit overhead costs of product nos. 156 and 157 if the expected manufacturing volume is attained.

C. Assuming use of activity-based costing, compute the total cost per unit of product no. 156.

D. If the company's selling price is based heavily on cost, would a switch to activity-based costing from the current traditional system result in a price increase or decrease for product no. 156? Show computations.

Definitions:

Q11: Collins Company, which pays a 10% commission

Q24: Which of the following would not be

Q35: The following selected information was extracted from

Q42: Howard Company has established the following standards:<br>Direct

Q43: Consider the following statements about absorption- and

Q58: When graphed, a typical fixed cost appears

Q75: All other things being equal, a company

Q78: The largest managerial accounting professional association in

Q80: Which of the following methods fully recognizes

Q95: The assignment of direct labor cost to