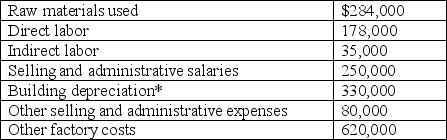

The following selected information was extracted from the 20x3 accounting records of Farrina Products:

*Seventy percent of the company's building was devoted to production activities; the remaining 30% was used for selling and administrative functions.

Farrina's beginning and ending work-in-process inventories amounted to $306,000 and $245,000, respectively. The company's beginning and ending finished-goods inventories were $450,000 and $440,000, respectively.

A. Calculate Farrina's manufacturing overhead for the year.

B. Calculate Farrina's cost of goods manufactured.

C. Compute Farrina's cost of goods sold.

Definitions:

Alimony

Financial support paid by one former spouse to another after divorce or separation, intended to provide for the recipient's needs.

Child Support

Child support refers to periodic payments made by a parent for the financial benefit of a child following the end of a marriage or other relationship, aimed at covering living expenses and needs of the child.

Chapter 7 Bankruptcy

This type of bankruptcy involves the liquidation of a debtor's assets to pay off creditors. It is the simplest and fastest form of bankruptcy and is available to individuals, married couples, corporations, and partnerships.

Special Bankruptcy Courts

Courts that specifically handle bankruptcy cases, part of the U.S. federal court system, dedicated to managing and adjudicating bankruptcy filings.

Q15: Inventory holding costs typically include:<br>A) clerical costs

Q25: Big Guy Inc. purchased 80% of the

Q29: Big Guy Inc. purchased 80% of the

Q35: The cost of the company's ending work-in-process

Q35: Errant Inc. purchased 100% of the outstanding

Q37: X Inc. owns 80% of Y Inc.

Q42: Which of the following is the proper

Q44: Activity-based costing systems:<br>A) use a single, volume-based

Q54: Which of the following can have a

Q80: Magnolia Industries combines all manufacturing overhead into