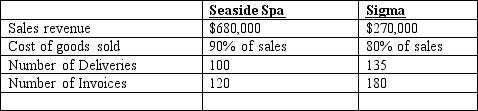

Anton's Fresh Fish and Produce is a wholesale distributor that operates in central Florida. An analysis of two of the company's customers, Seaside Spa and Sigma Assisted Living, reveals the data that follows the requirements for this problem for a recent 12-month period.

Anton's uses activity-based costing to determine the cost of servicing its customers. The company had total delivery costs during the year of $576,000 and 8,000 deliveries, along with cost of $765,000 for the administrative processing of 90,000 invoices.

Required:

A. Compute the pool rates for deliveries and invoice processing.

B. Compute the operating income that Anton's earned from these two customers.

C. Compute the total of customer-related costs (deliveries and invoice processing) for each customer as a percentage of gross margin, and analyze the results for management. Explain any significant differences that you find.

Definitions:

Operating Expenses

Costs associated with the day-to-day operations of a business, excluding the cost of materials and direct labor.

Interest Expense

The cost incurred by an entity for borrowed funds, typically reflected in the income statement as a deduction from earnings.

Accounts Receivable Turnover

A financial ratio that measures how often a company collects its average accounts receivable balance over a period.

Inventory Turnover

A metric that measures how many times a company's inventory is sold and replaced over a specified period.

Q33: The final step in recognizing the completion

Q49: All of the following are inventoried under

Q52: Which of the following employees would be

Q56: The two-stage cost allocation actually has three

Q58: As soon as products are completed, their

Q72: Hernandez Systems began business on January 1

Q75: Which of the following employees would not

Q78: A three-stage allocation process is used in

Q91: When determining customer profitability, activity-based costing can

Q109: Direct labor cost for August would