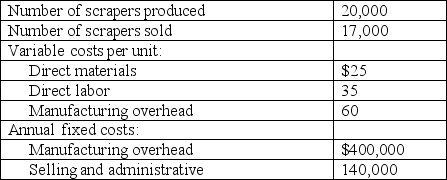

Miao Manufacturing, which began operations on January 1 of the current year, produces an industrial scraper that sells for $325 per unit. Information related to the current year's activities follows.

Miao carries its finished-goods inventory at the average unit cost of production. There was no work in process at year-end.

Required:

A. Compute the company's average unit cost of production.

B. Determine the cost of the December 31 finished-goods inventory.

C. Compute the company's cost of goods sold.

D. If next year's production increases to 23,000 units and general cost behavior patterns do not change, what is the likely effect on:

1. The direct-labor cost of $35 per unit? Why?

2. The fixed manufacturing overhead cost of $400,000? Why?

Definitions:

Biceps Brachii

A muscle located in the upper arm that helps control the motion of the shoulder and elbow, important for lifting and pulling actions.

Serratus Anterior

A muscle located on the side of the chest that assists in the movement of the shoulder blade (scapula), essential for activities like lifting arms and breathing.

Coracobrachialis

A muscle in the shoulder that helps in flexing and adducting the arm at the shoulder joint.

Pectoralis Major

A large muscle in the upper chest that contributes to arm movements such as flexion, adduction, and internal rotation, playing a key role in the shoulder's strength and stability.

Q3: Kwik Products uses a predetermined overhead application

Q6: King Corp. owns 80% of Kong Corp.

Q9: Ting Corp. owns 75% of Won Corp.

Q9: What is the total budgeted compensation for

Q10: GNR Inc. owns 100% of NMX Inc.

Q12: Using ONLY the assets test, determine which

Q27: Find Corp and has elected to use

Q35: The following selected information was extracted from

Q51: Find Corp and has elected to use

Q90: Consider the following statements regarding product-sustaining activities:<br>I.