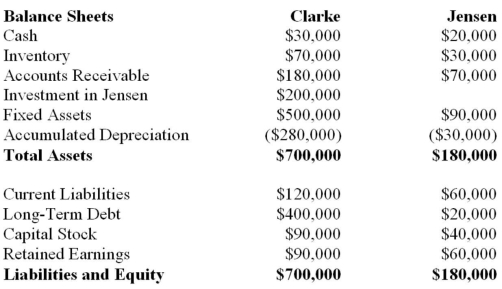

The following balance sheets have been prepared on December 31, 2013 for Clarke Corp. and Jensen Inc.  Additional Information: Clarke uses the cost method to account for its 50% interest in Jensen, which it acquired on January 1, 2010. On that date, Jensen's retained earnings were $20,000. The acquisition differential was fully amortized by the end of 2013. Clarke sold Land to Jensen during 2012 and recorded a $15,000 gain on the sale. Clarke is still using this Land. Clarke's December 31, 2013 inventory contained a profit of $10,000 recorded by Jensen. Jensen borrowed $20,000 from Clarke during 2013 interest-free. Jensen has not yet repaid any of its debt to Clarke. Both companies are subject to a tax rate of 20%. Prepare a Balance Sheet for Clarke on December 31, 2013 assuming that Clarke's Investment in Jensen is a joint venture investment and is reported using the equity method.

Additional Information: Clarke uses the cost method to account for its 50% interest in Jensen, which it acquired on January 1, 2010. On that date, Jensen's retained earnings were $20,000. The acquisition differential was fully amortized by the end of 2013. Clarke sold Land to Jensen during 2012 and recorded a $15,000 gain on the sale. Clarke is still using this Land. Clarke's December 31, 2013 inventory contained a profit of $10,000 recorded by Jensen. Jensen borrowed $20,000 from Clarke during 2013 interest-free. Jensen has not yet repaid any of its debt to Clarke. Both companies are subject to a tax rate of 20%. Prepare a Balance Sheet for Clarke on December 31, 2013 assuming that Clarke's Investment in Jensen is a joint venture investment and is reported using the equity method.

Definitions:

Truck Driver

An individual professionally licensed to operate trucks and responsible for transporting goods over short or long distances.

Employee

An individual who works under a contract of employment, receiving compensation for providing services to an employer.

Third Party

An individual or group besides the two primarily involved in a situation or contract, often implicated in legal or financial transactions.

Authorized

Having official permission or approval to do something, especially in a legal or formal context.

Q3: Big Guy Inc. purchased 80% of the

Q7: Harrison Industries began July with a finished-goods

Q12: Financial accounting focuses primarily on reporting:<br>A) to

Q14: The reciprocal-services method cannot be combined with

Q23: The joint cost allocated to P under

Q23: The cost of resources supplied but unused

Q34: How should the acquisition cost of a

Q47: 512) Find Corp and has elected to

Q49: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" " class="answers-bank-image d-block" rel="preload"

Q50: Which of the following employees at Clear