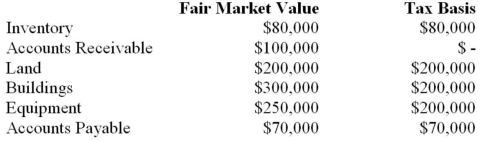

ABC Inc. has acquired all of the voting shares of DEF Inc and is gathering the necessary data to prepare consolidated financial statements. ABC paid $1,200,000 for its investment. Details of the companies' assets and liabilities on the acquisition date are shown below:  Required: Assuming that DEF hasn't set up Deferred Tax Asset or Liability accounts, determine the amounts that would be used to prepare the Consolidated Balance Sheet on the acquisition date. Assume a tax rate of 50%.

Required: Assuming that DEF hasn't set up Deferred Tax Asset or Liability accounts, determine the amounts that would be used to prepare the Consolidated Balance Sheet on the acquisition date. Assume a tax rate of 50%.

Definitions:

Mature Partnership Phase

A stage in a relationship or collaboration where all parties involved have developed a stable, trusting, and mutually beneficial bond.

Acquaintance Phase

An initial stage in team development or interpersonal relationships where members get to know each other and establish basic expectations.

Citizenship Behaviors

Actions by employees that are not part of their formal job requirements but that help to enhance the workplace and organization's functioning.

LMX

Leader-Member Exchange, a theory highlighting the dyadic relationship quality between leaders and their followers.

Q1: Using the step-down method and assuming the

Q3: LEO Inc. acquired a 60% interest in

Q13: Find Corp and has elected to use

Q24: Ting Corp. owns 75% of Won Corp.

Q26: Find Corp and has elected to use

Q31: Under the Equity Method, which of the

Q32: Which of the following is not a

Q35: Errant Inc. purchased 100% of the outstanding

Q36: On January 1, 2012, Hanson Inc. purchased

Q41: If the parent company used the equity