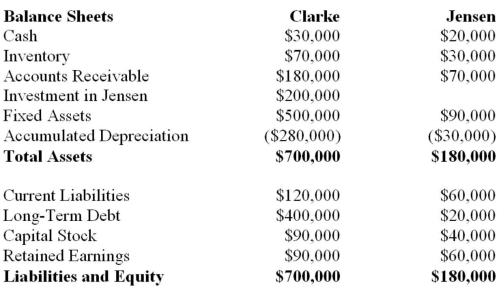

The following balance sheets have been prepared on December 31, 2013 for Clarke Corp. and Jensen Inc.  Additional Information: Clarke uses the cost method to account for its 50% interest in Jensen, which it acquired on January 1, 2010. On that date, Jensen's retained earnings were $20,000. The acquisition differential was fully amortized by the end of 2013. Clarke sold Land to Jensen during 2012 and recorded a $15,000 gain on the sale. Clarke is still using this Land. Clarke's December 31, 2013 inventory contained a profit of $10,000 recorded by Jensen. Jensen borrowed $20,000 from Clarke during 2013 interest-free. Jensen has not yet repaid any of its debt to Clarke. Both companies are subject to a tax rate of 20%. Prepare a Consolidated Balance Sheet for Clarke on December 31, 2013 assuming that Clarke's investment in Jensen is a control investment.

Additional Information: Clarke uses the cost method to account for its 50% interest in Jensen, which it acquired on January 1, 2010. On that date, Jensen's retained earnings were $20,000. The acquisition differential was fully amortized by the end of 2013. Clarke sold Land to Jensen during 2012 and recorded a $15,000 gain on the sale. Clarke is still using this Land. Clarke's December 31, 2013 inventory contained a profit of $10,000 recorded by Jensen. Jensen borrowed $20,000 from Clarke during 2013 interest-free. Jensen has not yet repaid any of its debt to Clarke. Both companies are subject to a tax rate of 20%. Prepare a Consolidated Balance Sheet for Clarke on December 31, 2013 assuming that Clarke's investment in Jensen is a control investment.

Definitions:

Bank Deposits

Funds placed into a bank account for safekeeping, which may bear interest over time.

Slow Payments

Delays in the settlement of financial obligations, typically in the context of customers taking longer than agreed to pay their invoices.

Cash Receipts

The collection of cash during a period, including cash received from customers, interest, and other sources.

Change Fund

A set amount of money used for making change in cash transactions, typically reserved in a cash register.

Q9: LEO Inc. acquired a 60% interest in

Q25: Big Guy Inc. purchased 80% of the

Q30: On January 1, 2012, Hanson Inc. purchased

Q35: On July 1, 2012, CDN purchased inventory

Q41: If a not-for-profit organization that has had

Q63: All companies define the value chain in

Q64: Hsu Company manufactures two products (A and

Q83: Boxer Industries worked on four jobs during

Q95: The assignment of direct labor cost to

Q111: Which of the following equations is used