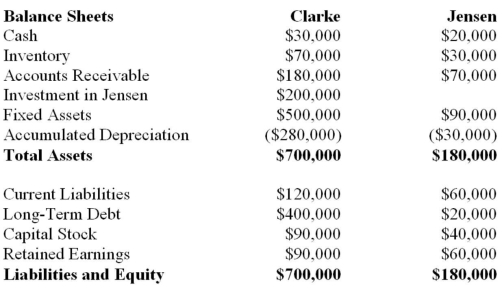

The following balance sheets have been prepared on December 31, 2013 for Clarke Corp. and Jensen Inc.  Additional Information: Clarke uses the cost method to account for its 50% interest in Jensen, which it acquired on January 1, 2010. On that date, Jensen's retained earnings were $20,000. The acquisition differential was fully amortized by the end of 2013. Clarke sold Land to Jensen during 2012 and recorded a $15,000 gain on the sale. Clarke is still using this Land. Clarke's December 31, 2013 inventory contained a profit of $10,000 recorded by Jensen. Jensen borrowed $20,000 from Clarke during 2013 interest-free. Jensen has not yet repaid any of its debt to Clarke. Both companies are subject to a tax rate of 20%. Prepare a Balance Sheet for Clarke on December 31, 2013 in accordance with current Canadian GAAP, assuming that Clarke's investment in Jensen is a significant influence investment and is reported using the equity method.

Additional Information: Clarke uses the cost method to account for its 50% interest in Jensen, which it acquired on January 1, 2010. On that date, Jensen's retained earnings were $20,000. The acquisition differential was fully amortized by the end of 2013. Clarke sold Land to Jensen during 2012 and recorded a $15,000 gain on the sale. Clarke is still using this Land. Clarke's December 31, 2013 inventory contained a profit of $10,000 recorded by Jensen. Jensen borrowed $20,000 from Clarke during 2013 interest-free. Jensen has not yet repaid any of its debt to Clarke. Both companies are subject to a tax rate of 20%. Prepare a Balance Sheet for Clarke on December 31, 2013 in accordance with current Canadian GAAP, assuming that Clarke's investment in Jensen is a significant influence investment and is reported using the equity method.

Definitions:

Product Costs

Costs that are assignable to the production of goods, including direct materials, direct labor, and manufacturing overhead.

Period Costs

Expenses that are not directly tied to the production process and are recorded as expense in the period they are incurred, such as selling, administrative, and general expenses.

Variable Cost

Charges that adjust seamlessly with the volume of manufacturing or services provided.

Manufacturing Overhead

The total of all overhead costs associated with the manufacturing process other than direct materials and direct labor. This includes costs such as maintenance, utilities, and equipment depreciation.

Q6: Consider the following items of information:<br>I. The

Q8: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) $686,700. B)

Q11: Telecom Inc has decided to purchase the

Q16: If a country's accounting income does not

Q16: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" What

Q17: The risk exposure resulting from the possible

Q17: The Financial Statements of Plax Inc. and

Q44: The relevant range for Maxco Industries is

Q51: Do-Good Inc. is a newly formed not-for-profit

Q70: The largest professional association for management accountants