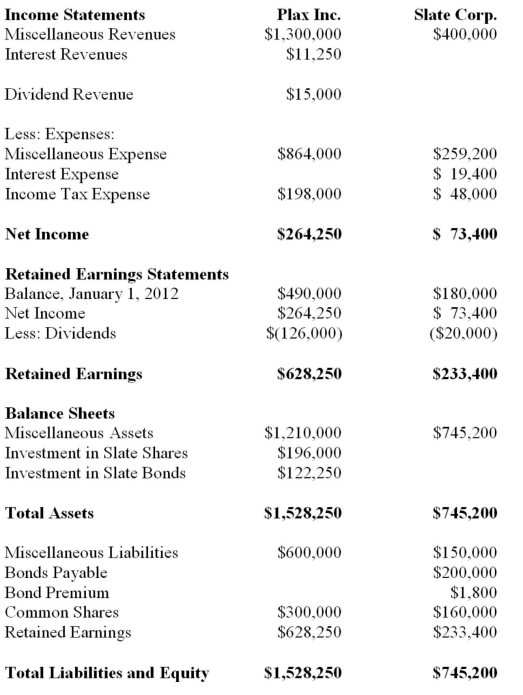

The Financial Statements of Plax Inc. and Slate Corp for the Year ended December 31, 2012 chapters)  Other Information:

Other Information:

▪Plax acquired 75% of Slate on January 1, 2008 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2009 and 2012 respectively.

▪Plax uses the cost method to account for its investment.

▪Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2015. The bonds were issued at a premium. On January 1, 2012 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

▪On January 1, 2012, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

▪Both companies are subject to a 40% Tax rate.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared. Prepare Plax's Consolidated Statement of Financial Position as at December 31, 2012.

Definitions:

Efficient Combination

The optimal mix of goods and services produced with given resources to achieve maximum value or output.

Total Quantity

The overall amount or volume of a product or resource available or produced.

Unit of Output

The measurement of what is produced or accomplished within a given timeframe or per cycle of operation, typically associated with productivity.

Entrepreneurial Ability

The human resource that combines the other economic resources of land, labor, and capital to produce new products or make innovations in the production of existing products; provided by entrepreneurs.

Q4: Starting in 2011, what is the definition

Q11: The Sarbanes-Oxley Act:<br>A) arose because of several

Q12: Amaz-a-nation reported the following data for the

Q18: Suppose that one hog yields 250 pounds

Q27: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) $805 CDN.

Q30: Errant Inc. purchased 100% of the outstanding

Q34: Downtown Hospital has two service departments (Patient

Q35: John Inc and Victor Inc for its

Q47: On July 1, 2013, Great White North

Q80: Which of the following methods fully recognizes